VWAP Algo (Best-Efforts)

Objective

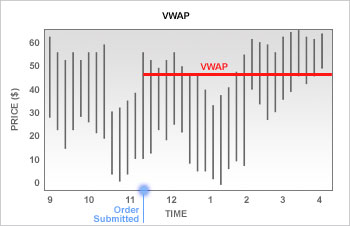

IB's best-efforts VWAP algo seeks to achieve the Volume-Weighted Average price (VWAP), calculated from the time you submit the order to the close of the market.

Best-efforts VWAP algo enables the user to attempt never to take liquidity while also trading past the end time. Because the order may not be filled on the bid or at the ask prices, there is a trade-off with this algo. The order may not fully fill if the user is attempting to avoid liquidity-taking fees and/or maximize liquidity-adding rebates, and may miss the benchmark by asking to stay on the bid or ask. The user can determine the maximum percentage of ADV (up to 50%) his order will comprise. The system will generate the VWAP from the time the order is entered through the close of trading, and the order can be limited to trading over a pre-determined period. The user can request the order to continue beyond its stated end time if unfilled at the end of the stated period. The best-efforts VWAP algo is available for all US equities.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

The IBKR VWAP order type can be configured to support orders related to Share Repurchases (Buy Backs) by considering and adhering to the conditions of Rule 10b-18. For more information, please contact your Sales Person or Client Support Team.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Futures | US Products | Smart | Attribute | ||||

| Stocks | Non-US Products* | Directed | Order Type | ||||

| IB Algo | Time in Force | ||||||

| IB Algo | |||||||

| *Available for Australian stocks. *Available for Canadian, European, Japanese and Hong Kong stocks for customers who use the Tiered pricing structure. |

|||||||

| Open Users' Guide | |||||||