Relative/Pegged-to-Primary Orders

Relative (a.k.a. Pegged-to-Primary) orders provide a means for traders to seek a more aggressive price than the National Best Bid and Offer (NBBO). By acting as liquidity providers and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their orders. Quotes are automatically adjusted as the markets move, to remain aggressive.

- Directed orders, including orders sent to IBKR ATS, will float both ways with the market.

- Smart-Routed buy orders are pegged to the NBB by a more aggressive offset. If the NBB moves up, your bid will also move up. If the NBB moves down, there will be no adjustment.

- Smart-Routed sell orders are pegged to the NBO by a more aggressive offset. If the NBO moves down, your offer will also move down. If the NBO moves up, there will be no adjustment.

In addition to the offset, you can define an absolute cap that works like a limit price, and will prevent your order from being executed above or below a specified price level.

For orders routed to IBKR ATS, the system automatically caps the order price at the "opposite" side of the BBO plus/minus 1 tick. For example, if the NBBO is $10.10 - $10.12 and you submit a RELATIVE buy order directed to IBKR ATS and with an $0.02 offset, with no cap the order price would be the bid ($10.10) + offset ($0.02) = $10.12. To keep the order more aggressive, we apply the price cap at the opposite side of the BBO (in this case as the offer) minus 1 tick, or $10.12 - $0.01 = $10.11.

Orders with a "0" offset are submitted as limit orders at the best bid/ask and will move up and down with the market to continue to match the inside quote. You must specify the value "0" or "0.0" in TWS to submit an order with no offset.

If you submit a relative order with a percentage offset, you are instructing us to calculate an order price that is consistent with the offset, but that also complies with applicable tick increments. Therefore we will calculate the order price rounded to the appropriate tick increment (e.g., pennies for a U.S. stock trading at a price over $1.00). Buy orders will be rounded down to the nearest acceptable tick increment and sell orders will be rounded up.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Stocks | US Products | Smart | Attribute | ||||

| Options | Non-US Products | Directed* | Order Type | ||||

| Futures | IBKRATS | Time in Force | |||||

* Orders with a positive offset that are directed to Island will float up and down with the market. |

|||||||

| Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

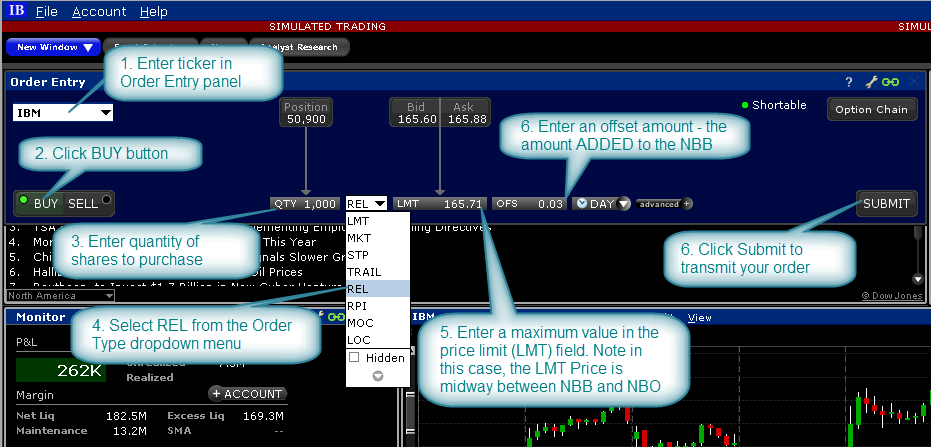

Mosaic Example

In this example of a Relative order type, assume we want to buy an additional 1,000 shares in ticker IBM, where the NBBO is $165.60/88. We do not want to pay any higher than $165.71 for the order but want to be three-cents more aggressive than the best displayed bid in the market. Having entered the ticker symbol, we set the destination to Smart, click the BUY button, enter 1,000 shares in the Quantity field and select REL from the Order Type dropdown menu to create a Relative order. Enter the desired limit price for your order.

In this case we entered $165.71, which is the midpoint of the NBBO. Entering a value in the Offset input field determines exactly how aggressive we want the order to be. By entering three-cents as the value in this field, we are pegging our bid to three-cents ABOVE the NBB. As the market rises, our bid will rise to remain more aggressive than the market but is limited to a maximum limit price of $165.71. Should the market start to move lower, the bid will remain aggressive until filled instead of remaining pegged to the bid. Once you are happy with your inputs, click the Submit button to enter the order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1,000 |

| Order Type | REL |

| Market Price (NBBO) Range | $165.60-165.88 |

| Limit Price (Price Cap) | 165.71 |

| Offset (Relative) Amount | 0.03 |

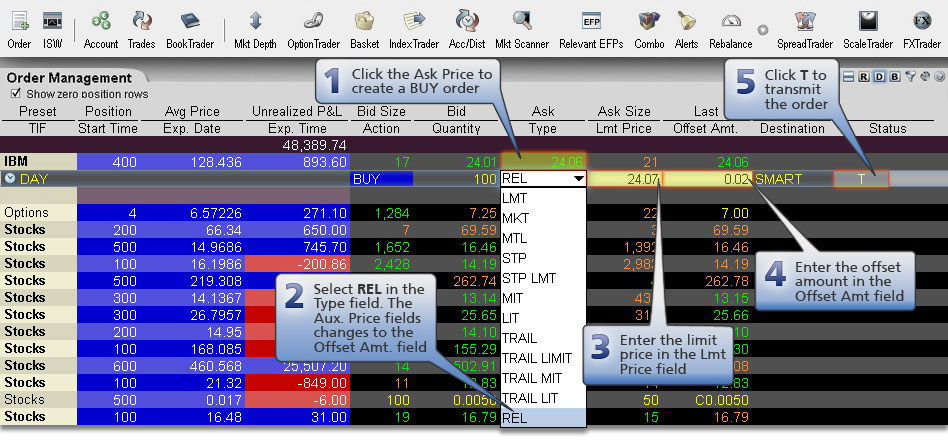

Classic TWS Example

Order Type In Depth - Relative/Pegged-to-Primary Buy Order

Step 1 – Enter a Relative/Pegged-to-Primary Buy Order

When you use a Relative (or Pegged-to-Primary) order, the value in the Limit Price field becomes the price cap, and the order price is calculated (but not displayed) using the NBB plus the offset amount (the relative amount) for a buy order, and the NBO minus the offset amount for a sell order. You want to buy 100 shares of XYZ, and you want to place a more aggressive bid than the current best bids to increase your odds of filling the order.

The current NBBO for shares of of XYZ stock is $24.01 - 24.06. You create a buy order for 100 shares and select REL as the order type. You enter 24.07 as the limit price, which is the price cap for your order; this is the most you are willing to pay. You enter an offset amount of 0.02, then transmit the order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | REL |

| Market Price (NBBO) Range | $24.01 - 24.06 |

| Limit Price (Price Cap) | 24.07 |

| Offset (Relative) Amount | 0.02 |

Step 2 – Order Transmitted

Your relative/pegged-to-primary order is initially submitted with a bid of $24.03 (NBB of 24.01 + 0.02 offset amount), which is more aggressive than the NBB of $24.01 and better than the $24.06 you would have to pay as a liquidity taker.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | REL |

| Market Price (NBBO) Range | $24.01 - 24.06 |

| Limit Price (Price Cap) | 24.07 |

| Offset (Relative) Amount | 0.02 |

| Bid | 24.03 |

Step 3 – Price Rises, Order is Not Executed

The market rises and the NBBO for shares of XYZ rises to $24.03 - $24.08. Your bid moves with it to $24.05. The order does not execute. If the market continued to rise to $24.07 - 24.10, your bid would be capped at $24.07.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | REL |

| Market Price (NBBO) Range | $24.03 - 24.08 |

| Limit Price (Price Cap) | 24.07 |

| Offset (Relative) Amount | 0.02 |

| Bid | 24.05 |

Step 4 – Price Falls, Order is Executed

The market now falls and the NBBO for XYZ shares falls to $23.98 - 24.03. Your bid stays at $24.05 and executes at that price.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | REL |

| Market Price (NBBO) Range | $23.98 - 24.03 |

| Limit Price (Price Cap) | 24.07 |

| Offset (Relative) Amount | 0.02 |

| Bid | 24.05 |